Financial Modeling and Valuation Analyst (FMVA®) Certification

Industry Projects-Based Bootcamp Created by Hiring Managers

The Financial Modeling & Valuation Analyst (FMVA) Certification Course is designed to equip you with practical skills in Financial Modeling, Valuation, Budgeting, Forecasting, and Financial Analysis using Excel. Through real-world case studies and hands-on projects, you'll learn how to build dynamic Financial Models, perform Company Valuations using DCF and other techniques, and analyze Financial Statements with confidence. By the end of the course, you'll be fully prepared to take on roles in Investment Banking, Corporate Finance, and Equity Research, with the ability to make informed Financial Decisions and Present Insights to Key Stakeholders.

50+

Case Studies

01

Virtual Internship

01 Year

LMS Access

10+

Industrial Projects

1000+

Enrolled Students

Free

Portfolio Website

Created by: Saif Ali & Muhammad Abbas

Join our Bootcamp

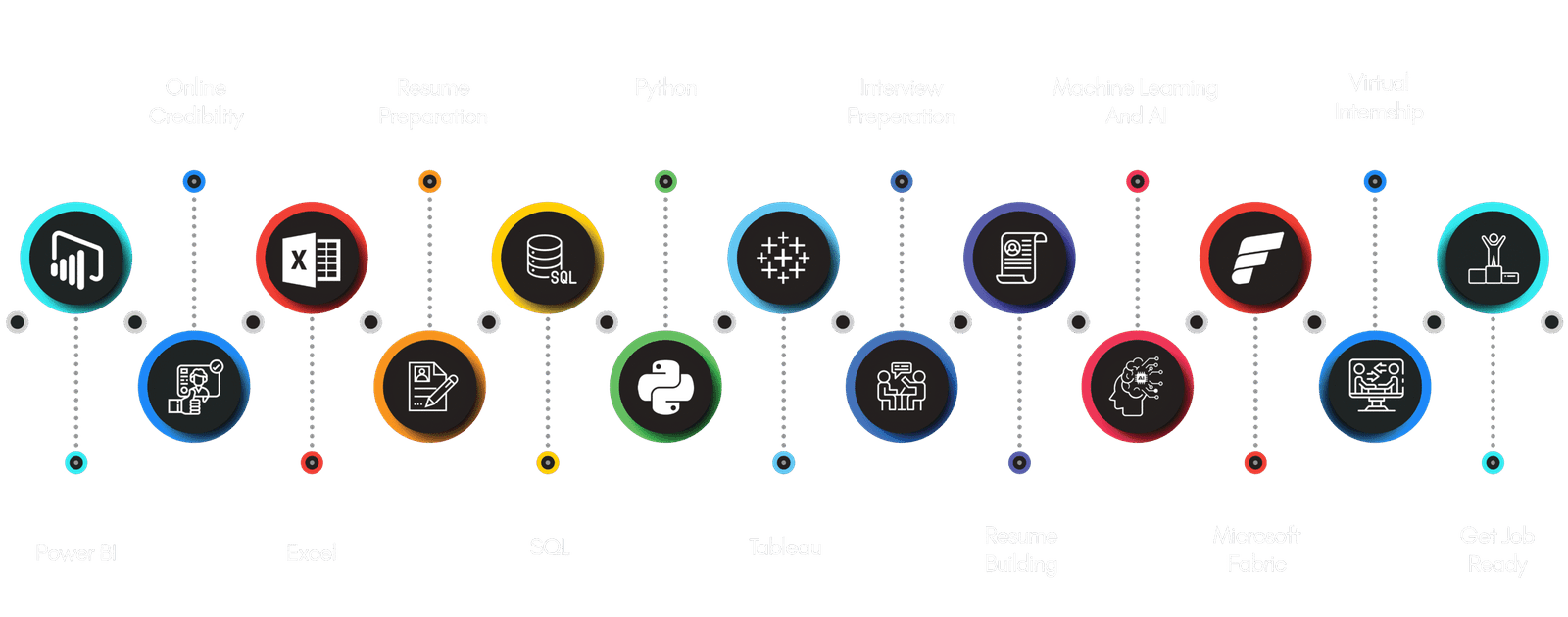

Learn in-demand Skills

Get Hired by Top Companies

No Questions Asked Refund Policy

Get your money within 30 days of enrollment

Why is this the Most Effective Financial Modeling and Valuation Analyst (FMVA®) Certification Program????

Our unlimited daily doubt clearance support through a dedicated WhatsApp community ensures you receive instant guidance, keeping your learning journey smooth and uninterrupted.

We emphasize practical job readiness by offering resume and interview preparation, interview leads, building online credibility, and mock interview sessions to boost your confidence and set you apart from the competition.

Our highly engaging content is designed to simulate real business environments, with practice problems and realistic business meeting scenarios. Under the guidance of Leading Industry Experts, you’ll learn complex topics through simple and effective explanations.

At Analytix Camp, we provide unmatched job assistance to help you succeed in your career. From crafting ATS-friendly resumes to offering a $1000 worth portfolio website and LinkedIn profile optimization, we ensure you have the tools to showcase your work and impress potential employers.

Hear It From

Our Happy Learners

Our content is rated 4.84 from 128 Learners

Enrolling in the MS Power BI course was a game-changer! The comprehensive content, hands-on exercises, and expert instructors exceeded my expectations. Highly recommend this course to anyone seeking in-depth Power BI knowledge. Ready to apply these skills in real-world scenarios. 5/5 stars!

Zeeshan Afzal

Accountant

This course was taught with simplicity and empathy, a novice user could've benefited from this course as much as an advance user could. Fundamentals of data analytics explained in detail with enough practice to be applied in real world scenarios right after taking the lesson! Highly recommended course for everyone who are looking to hone their data analytics skills be it professionals or business managers like myself who wants to add to their skillset

Malik Musab Asif

Business Operations Management

I recently completed the Excel and BI course, and I found it to be satisfactory. The course covered a comprehensive range of Excel and Business Intelligence topics, and I gained valuable insights and skills throughout the duration. course provided a solid foundation in both Excel and Business Intelligence. The well-structured content, engaging instructors, and practical exercises make it a commendable choice for individuals looking to enhance their skills in these areas. I feel well-equipped to apply what I've learned in real-world scenarios.

Syeda Yusra Gul

Teacher

It's been wonderful experience with sir Abbas and the way he teaches and facilitates, is also great. I learned so many advance concepts of Excel and getting exposure with Power BI fundamentals was good for me because learning a new things always keep me passionate.

Haseebullah Shah

Information Security Engineer

The Advanced Excel and Power BI course provided a comprehensive dive into data analysis and visualization. The curriculum covered complex Excel functions, pivot tables, and Power BI dashboard creation. Instructors were knowledgeable, and hands-on projects enhanced practical skills. A valuable course for anyone seeking proficiency in data-driven decision-making.

Muhammad Salman

Student

You Can

Work On Real World Projects That Hiring Managers Like

Aisha Steel Mills - Valuation Report

This Excel project develops a comprehensive equity valuation model for Aisha Steel Mills. The analysis includes historical financial statement analysis, revenue and cost forecasting, capital expenditure modeling, and working capital assumptions. A Discounted Cash Flow (DCF) valuation is performed using WACC and terminal value estimation, supported by relative valuation multiples such as P/E and EV/EBITDA. Sensitivity and scenario analysis evaluate valuation under different steel price and demand assumptions.

Fauji Cement - Valuation Report

This Excel-based valuation project focuses on Fauji Cement, emphasizing the cement industry’s cost structure and cyclical nature. The model incorporates revenue projections, energy and raw material cost forecasting, capacity utilization, and margin analysis. Valuation is conducted using DCF and comparable company analysis, with sensitivity analysis to assess the impact of fuel costs, pricing changes, and demand cycles on intrinsic value.

Ghandhara Industries - Valuation Report

This project presents an Excel financial model for valuing Ghandhara Industries. The model analyzes historical performance, operating leverage, and return metrics such as ROE and ROIC. Forecasts are built based on production volumes and demand assumptions, followed by valuation using cash flow modeling and market multiples. Scenario analysis highlights the effect of growth rates and margin changes on shareholder value.

PTCL - Valuation Report

This Excel project develops a telecom-sector valuation model for PTCL. It includes subscriber-based revenue modeling, operating expense forecasting, capital expenditure planning, and free cash flow estimation. A DCF valuation framework is used to estimate intrinsic equity value, supported by peer multiple comparisons. Sensitivity analysis demonstrates the impact of ARPU growth, discount rates, and capital intensity on valuation outcomes.

Systems Limited - Valuation Report

This Excel-based project focuses on valuing Systems Limited, a high-growth technology and IT services company. The model emphasizes revenue segmentation, export growth, operating margin expansion, and scalability. A growth-oriented DCF model is built, complemented by relative valuation multiples. Scenario and sensitivity analysis assess valuation changes under different growth, margin, and WACC assumptions, reflecting FMVA best practices.

Varun Beverages - Valuation Report

This project delivers a detailed Excel valuation model for Varun Beverages within the FMCG sector. The model includes volume-driven revenue forecasts, cost structure analysis, and margin projections. Valuation is performed using DCF and EV/EBITDA multiple analysis, with scenario testing to evaluate the impact of expansion plans, input cost fluctuations, and demand growth on intrinsic value.

Rainbow Children Hospital - Valuation Report

This Excel-based project builds an equity valuation model for Rainbow Children Hospital within the healthcare sector. It analyzes historical financials, patient volumes, occupancy rates, revenue per bed, and cost structure, incorporating expansion and capex assumptions. Valuation is conducted using a DCF approach supported by EV/EBITDA multiples, with sensitivity analysis on margins, occupancy, and WACC.

Amazon Corp - Valuation Report

This Excel project develops a detailed equity valuation model for Amazon Corp, focusing on its diversified business segments including e-commerce, cloud services (AWS), and digital advertising. The model includes historical financial analysis, segment-wise revenue forecasting, operating margin assumptions, capital expenditure planning, and working capital modeling. A Discounted Cash Flow (DCF) valuation is performed, supported by relative valuation multiples. Sensitivity and scenario analysis assess valuation impact under varying growth, margin, and discount rate assumptions.

Apple Corp - Valuation Report

This Excel-based valuation project analyzes Apple Corp with emphasis on product-driven revenue streams and ecosystem-based profitability. The model forecasts revenue by product category, gross margin trends, operating expenses, and free cash flows. A DCF valuation framework is used alongside comparable company analysis to estimate intrinsic value. Scenario analysis evaluates the effect of product demand, pricing power, and margin sustainability on long-term valuation.

Tesla Corp - Valuation Report

This project presents a growth-oriented Excel valuation model for Tesla Corp, highlighting its automotive, energy, and technology-driven revenue streams. The model incorporates vehicle delivery growth, pricing assumptions, operating leverage, and capital investment planning. Valuation is conducted using a DCF model with long-term growth assumptions, complemented by market multiples. Sensitivity analysis examines valuation exposure to changes in growth rates, margins, and WACC.

Leverage Buyout (LBO) Modeling

This Excel project develops a complete Leveraged Buyout (LBO) model, simulating the acquisition of a target company by a private equity firm. The model includes transaction assumptions, debt structuring, interest schedules, cash flow sweeps, and exit valuation. Key outputs include IRR, MOIC, and exit sensitivity analysis, enabling evaluation of returns under different leverage, holding periods, and exit multiple scenarios.

Merger and Acquisition (M&A) Modeling

This Excel-based M&A model evaluates the financial impact of an acquisition between an acquirer and a target company. The model includes purchase price allocation, financing mix (cash, debt, equity), synergy estimation, and pro forma financial statements. Accretion/dilution analysis is performed to assess EPS impact, while scenario analysis evaluates deal attractiveness under different synergy and financing assumptions.

Real Estate Modeling

This Excel project delivers a comprehensive real estate financial model for evaluating property investments. The model includes rental income projections, operating expense analysis, vacancy assumptions, financing structure, and capital expenditure planning. Valuation is performed using cash flow modeling, IRR, NPV, and exit capitalization rate analysis, with sensitivity testing to assess investment performance under varying rent growth and interest rate scenarios.

Meet the ones

Teaching You

Saif Ali

Saif Ali is a Compliance and Risk Management professional with over 5 years of experience in AML, CFT, KYC, and Transaction Monitoring. He holds an MBA in Finance and Risk Management from IoBM and certifications in KYC, Sanctions Compliance, and Transaction Monitoring.

Muhammad Abbas

Muhammad Abbas is a certified Data Analyst with over 7 years of experience in Analytics and Business Intelligence. With an MBA in Finance from Iqra University and an ACCA qualification, he serves as a Business Intelligence Analyst at TechFlow Inc., USA, and runs a popular YouTube channel on Analytics and Career Growth.

Overview

What you'll learn in this Bootcamp

Excel - Mother of Financial Analysis

15h:42m:53s On Demand Videos

8 Lectures

1.1:

2.2:

3.3:

4.4:

5.5:

6.6:

7.7:

8.8:

Where Numbers Start Telling Business Stories

03h:12m:52s On Demand Videos

5 Lectures

1.1:

2.2:

3.3:

4.4:

5.5:

Because Smart Analysts Don’t Click Repeatedly

05h:21m:42s On Demand Videos

54 Lectures

1.1: WSO Academy: Land Your High-Finance Role

1.2: Introduction

1.3: Before we begin

1.4: Special instructions for Office 365 users

1.5: What is a macro

1.6: How VBA can be used

1.7: VBA Limitations

1.8: VBA in action

1.9: Setting up our workbooks for macros

1.10: The Developer tab

1.11: Visual Basic Editor overview

1.12: Coding basics

1.13: Running your code

1.14: Keeping your code clean

2.1: Referencing a range

2.2: Referencing a named range

2.3: Referencing a worksheet

2.4: Passing values

2.5: Intro to variables

2.6: Declaring a variable part 1

2.7: Declaring a variable part 2

2.8: Using constants

2.9: Debugging your code

2.10: Creating message boxes

2.11: Case study intro

2.12: Case study solution

3.1: Finding the row number

3.2: Finding the last row

3.3: Offset function

3.4: IF Then function

3.5: Mini case study overview (IF Then function)

3.6: Mini case study solution

3.7: Intoduction to loops

3.8: For next loops in action

3.9: Additional For next loop practice

3.10: Introduction to functions

3.11: Functions in action

3.12: Additional function practice

3.13: Working with multiple subs

3.14: Public variables

3.15: Case study introduction

3.16: Case study solution

4.1: Running your code

4.2: Error handling

4.3: Recording a macro

4.4: How recording a macro works

4.5: Automating code creation with AI

4.6: Putting AI tools into practice

4.7: Case study introduction

4.8: Case study solution

5.1: Case study 1 introduction

5.2: Case study 1 solution

5.3: Case study 2 introduction

5.4: Case study 2 solution

Reading the Story Behind the Numbers

05h:42m:31s On Demand Videos

5 Lectures

1.1:

2.2:

3.3:

4.4:

5.5:

Turning Assumptions into Financial Reality

08h:31m:59s On Demand Videos

3 Lectures

1.1:

2.2:

3.3:

When Theory Meets Boardroom Decisions

15h:10m:53s On Demand Videos

28 Lectures

1.1: Financial Modeling Best Practices

1.2: Model Setup and Assumptions

1.3: Forecast Revenues Down to EBITDA

1.4: Forecast Working Capital and PP&E

1.5: Forecast Capital Structure

1.6: Complete Cash Flow Statement

1.7: Review and Audit

2.1: Financial Modeling Best Practices

2.2: Modeling Cash Flows (Review)

2.3: Building Your Financial Model in Excel

2.4: Enhancing Your Model

2.5: Final Product

3.1: e-Commerce Business Landscape & Revenue Drivers

3.2: Building Smart Assumptions for Scalable Financial Models

3.3: Crafting a Dynamic Income Statement for Startups

3.4: Designing a Startup-Friendly Balance Sheet

3.5: Integrating Key Financial Schedules Seamlessly

3.6: Startup Cash Flow Modeling & Forecasting Techniques

3.7: Customer Metrics That Drive Growth & Valuation

3.8: Visualizing Financial Insights with Impactful Charts & Dashboards

4.1: Understanding the Gaming App Ecosystem & Revenue Streams

4.2: Building Assumptions for User Growth, Retention & Monetization

4.3: Modeling In-App Revenue, Developer Costs & Platform Fees

4.4: Constructing Financial Statements Tailored to Gaming Startups

4.5: Player Metrics & KPI Dashboards for Performance Tracking

4.6: Completing the Financial Model

5.5:

6.6:

Finding the True Worth Behind the Price

12h:22m:53s On Demand Videos

7 Lectures

1.1:

2.2:

3.3:

4.4:

5.5:

6.6:

7.7:

Valuing Companies the Way Markets Do

11h:30m:12s On Demand Videos

4 Lectures

1.1:

2.2:

3.3:

4.4:

Real Businesses. Real Numbers. Real Decisions.

15 h On Demand Videos

24 Lectures

1.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

1.2: Extracting and Cleaning Financial Data from Annual Reports & PSX Filings

1.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

1.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

1.5: Forecasting Future Financial Performance Using Market Research

1.6: Valuing the Company Using DCF & Trading Multiples

2.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

2.2: Extracting and Cleaning Financial Data from Annual Reports & PSX Filings

2.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

2.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

2.5: Forecasting Future Financial Performance Using Market Research

2.6: Valuing the Company Using DCF & Trading Multiples

3.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

3.2: Extracting and Cleaning Financial Data from Annual Reports & PSX Filings

3.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

3.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

3.5: Forecasting Future Financial Performance Using Market Research

3.6: Valuing the Company Using DCF & Trading Multiples

4.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

4.2: Extracting and Cleaning Financial Data from Annual Reports & PSX Filings

4.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

4.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

4.5: Forecasting Future Financial Performance Using Market Research

4.6: Valuing the Company Using DCF & Trading Multiples

Scaling Finance Across High-Growth Markets

12 Lectures

1.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

1.2: Extracting and Cleaning Financial Data from Annual Reports

1.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

1.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

1.5: Forecasting Future Financial Performance Using Market Research

1.6: Valuing the Company Using DCF & Trading Multiples

2.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

2.2: Extracting and Cleaning Financial Data from Annual Reports

2.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

2.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

2.5: Forecasting Future Financial Performance Using Market Research

2.6: Valuing the Company Using DCF & Trading Multiples

Global Finance Through a Single Model

16 Lectures

1.1: Forecast all Financial line items

1.2: Build a 3-Statement Financial Model

1.3: Calculate WACC, Growth rate, and Key metrics

1.4: Perform Valuation using DCF and Comparables

2.1: Forecast all Financial line items

2.2: Build a 3-Statement Financial Model

2.3: Calculate WACC, Growth rate, and Key metrics

2.4: Perform Valuation using DCF and Comparables

3.1: Forecast all Financial line items

3.2: Build a 3-Statement Financial Model

3.3: Calculate WACC, Growth rate, and Key metrics

3.4: Perform Valuation using DCF and Comparables

4.1: Forecast all Financial line items

4.2: Build a 3-Statement Financial Model

4.3: Calculate WACC, Growth rate, and Key metrics

4.4: Perform Valuation using DCF and Comparables

Selling Numbers with Confidence and Clarity

15 h On Demand Videos

26 Lectures

1.1: Choosing Professional Color Themes and Keeping Slides Consistent

1.2: Formatting Slide Titles, Lines, and Shapes Cleanly

1.3: Using Slide Master to Maintain a Uniform Design

1.4: Creating Clear Heading Bars and Easy-to-Read Tables

2.1: Adding and Linking Excel Tables into PowerPoint Slides

2.2: Importing and Updating Excel Charts in Presentations

3.1: Using Background Images and Color Overlays Effectively

3.2: Cropping Images and Applying Professional Image Styles

3.3: Adding Simple Animations to Text, Charts, and Objects

3.4: Using Transitions to Create Smooth Slide Flow

4.1: Creating Hidden Slides for Extra or Backup Content

4.2: Using Presenter View for Confident Delivery

4.3: Adding Comments and Working with Team Feedback

4.4: Sharing and Exporting Presentations Professionally

5.1: Best Practices for Writing Clear and Professional Reports

5.2: Creating a Well-Structured Table of Contents

5.3: Writing a Clear and Insightful Executive Summary

5.4: Using Section Dividers for Better Report Navigation

5.4: Preparing a Strong Company Overview Section

6.1: Adding and Formatting Tables and Charts in Reports

6.2: Improving Layout, Alignment, and Visual Balance

6.3: Creating Clear and Professional Project Timelines

6.4: Writing and Presenting the Valuation Summary

6.5: Preparing a Concise Industry Overview

6.6: Writing a Strong Conclusion with Key Takeaways

6.7: Understanding Disclaimers, Footnotes, and Disclosures

Where Deals Are Built and Billion-Dollar Decisions Begin

30h:00m:00s On Demand Videos

40 Lectures

1.1: Accretion–Dilution, EPS Impact & Value Creation

1.2: Buyers, Strategy & M&A Modeling Framework

1.3: Course Introduction & M&A Overview

1.4: Deal Structure, Consideration & Key Assumptions

1.5: Pro Forma Balance Sheet & Consolidation Mechanics

1.6: Pro Forma DCF Valuation

1.7: Purchase Price, Equity Structure & PPA

1.8: Revenue, Cost Integration & Pro Forma Financials

1.9: Scenario Testing, Sensitivity Analysis & Model Review

1.10: Standalone Financial Model Structure & Statement Mapping

1.11: Transaction Stub Periods & Stub Financials

1.12: Working Capital, Depreciation, Debt & Cash Flow Modeling

2.1: Core Financial Statements & Cash Flow Mechanics

2.2: Dashboards, Model Validation, Circularity Control & Course Wrap-Up

2.3: Debt Repayment Profiles, Credit Metrics & Covenant Analysis

2.4: Enterprise Value, EBITDA Normalization & Exit Strategies

2.5: Equity Schedules, Cash Distributions & Exit Equity Value

2.6: Financing Assumptions, Fees & Debt Instrument Overview

2.7: Introduction to Leveraged Buyouts & LBO Transaction Overview

2.8: LBO Model Architecture, Design Standards & Full Model Tour

2.9: LBO Rationale, Buyers, Risks, Return Drivers & Market Context

2.10: Operating Assumptions & Revenue and Cost Modeling

2.11: Purchase Price Mechanics & Equity Offer Value

2.12: Returns Analysis, IRR, Cash-on-Cash & Sensitivity Tables

2.13: Revolver Modeling & Short-Term Liquidity Management

2.14: Sources and Uses of Funds & Capital Structure Setup

2.15: Term Loans, Subordinated Debt & Interest Calculations

2.16: Model Circularity and Checks

3.1: Course Introduction, Key Terms & Project Finance Fundamentals

3.2: Development Overview, Property Statistics & Cost Structure

3.3: Development Pro Forma, Sensitivity Analysis & Final Outputs

3.4: Distribution Waterfalls, Investor Returns & IRR Scenarios

3.5: Expense Modeling & Net Cash Flow Mechanics

3.6: Financing Structure: Land Loan, Construction Loan & Debt Schedules

3.7: Joint Ventures, Equity Contributions & Waterfall Structures

3.8: Levered Cash Flows, IRR & Project Returns

3.9: Model Assumptions Framework & Data Inputs

3.10: NOI, Cap Rates & Core Valuation Concepts

3.11: Real Estate Development Timeline, Capital Stack & Modeling Best Practices

3.12: Revenue Modeling: Absorption, Closings & Sales Build-Up

Excel - Mother of Financial Analysis

15h:42m:53s On Demand Videos

8 Lectures

1.1:

2.2:

3.3:

4.4:

5.5:

6.6:

7.7:

8.8:

Where Numbers Start Telling Business Stories

03h:12m:52s On Demand Videos

5 Lectures

1.1:

2.2:

3.3:

4.4:

5.5:

Because Smart Analysts Don’t Click Repeatedly

05h:21m:42s On Demand Videos

54 Lectures

1.1: WSO Academy: Land Your High-Finance Role

1.2: Introduction

1.3: Before we begin

1.4: Special instructions for Office 365 users

1.5: What is a macro

1.6: How VBA can be used

1.7: VBA Limitations

1.8: VBA in action

1.9: Setting up our workbooks for macros

1.10: The Developer tab

1.11: Visual Basic Editor overview

1.12: Coding basics

1.13: Running your code

1.14: Keeping your code clean

2.1: Referencing a range

2.2: Referencing a named range

2.3: Referencing a worksheet

2.4: Passing values

2.5: Intro to variables

2.6: Declaring a variable part 1

2.7: Declaring a variable part 2

2.8: Using constants

2.9: Debugging your code

2.10: Creating message boxes

2.11: Case study intro

2.12: Case study solution

3.1: Finding the row number

3.2: Finding the last row

3.3: Offset function

3.4: IF Then function

3.5: Mini case study overview (IF Then function)

3.6: Mini case study solution

3.7: Intoduction to loops

3.8: For next loops in action

3.9: Additional For next loop practice

3.10: Introduction to functions

3.11: Functions in action

3.12: Additional function practice

3.13: Working with multiple subs

3.14: Public variables

3.15: Case study introduction

3.16: Case study solution

4.1: Running your code

4.2: Error handling

4.3: Recording a macro

4.4: How recording a macro works

4.5: Automating code creation with AI

4.6: Putting AI tools into practice

4.7: Case study introduction

4.8: Case study solution

5.1: Case study 1 introduction

5.2: Case study 1 solution

5.3: Case study 2 introduction

5.4: Case study 2 solution

Reading the Story Behind the Numbers

05h:42m:31s On Demand Videos

5 Lectures

1.1:

2.2:

3.3:

4.4:

5.5:

Turning Assumptions into Financial Reality

08h:31m:59s On Demand Videos

3 Lectures

1.1:

2.2:

3.3:

When Theory Meets Boardroom Decisions

15h:10m:53s On Demand Videos

28 Lectures

1.1: Financial Modeling Best Practices

1.2: Model Setup and Assumptions

1.3: Forecast Revenues Down to EBITDA

1.4: Forecast Working Capital and PP&E

1.5: Forecast Capital Structure

1.6: Complete Cash Flow Statement

1.7: Review and Audit

2.1: Financial Modeling Best Practices

2.2: Modeling Cash Flows (Review)

2.3: Building Your Financial Model in Excel

2.4: Enhancing Your Model

2.5: Final Product

3.1: e-Commerce Business Landscape & Revenue Drivers

3.2: Building Smart Assumptions for Scalable Financial Models

3.3: Crafting a Dynamic Income Statement for Startups

3.4: Designing a Startup-Friendly Balance Sheet

3.5: Integrating Key Financial Schedules Seamlessly

3.6: Startup Cash Flow Modeling & Forecasting Techniques

3.7: Customer Metrics That Drive Growth & Valuation

3.8: Visualizing Financial Insights with Impactful Charts & Dashboards

4.1: Understanding the Gaming App Ecosystem & Revenue Streams

4.2: Building Assumptions for User Growth, Retention & Monetization

4.3: Modeling In-App Revenue, Developer Costs & Platform Fees

4.4: Constructing Financial Statements Tailored to Gaming Startups

4.5: Player Metrics & KPI Dashboards for Performance Tracking

4.6: Completing the Financial Model

5.5:

6.6:

Finding the True Worth Behind the Price

12h:22m:53s On Demand Videos

7 Lectures

1.1:

2.2:

3.3:

4.4:

5.5:

6.6:

7.7:

Valuing Companies the Way Markets Do

11h:30m:12s On Demand Videos

4 Lectures

1.1:

2.2:

3.3:

4.4:

Real Businesses. Real Numbers. Real Decisions.

15 h On Demand Videos

24 Lectures

1.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

1.2: Extracting and Cleaning Financial Data from Annual Reports & PSX Filings

1.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

1.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

1.5: Forecasting Future Financial Performance Using Market Research

1.6: Valuing the Company Using DCF & Trading Multiples

2.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

2.2: Extracting and Cleaning Financial Data from Annual Reports & PSX Filings

2.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

2.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

2.5: Forecasting Future Financial Performance Using Market Research

2.6: Valuing the Company Using DCF & Trading Multiples

3.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

3.2: Extracting and Cleaning Financial Data from Annual Reports & PSX Filings

3.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

3.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

3.5: Forecasting Future Financial Performance Using Market Research

3.6: Valuing the Company Using DCF & Trading Multiples

4.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

4.2: Extracting and Cleaning Financial Data from Annual Reports & PSX Filings

4.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

4.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

4.5: Forecasting Future Financial Performance Using Market Research

4.6: Valuing the Company Using DCF & Trading Multiples

Scaling Finance Across High-Growth Markets

12 Lectures

1.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

1.2: Extracting and Cleaning Financial Data from Annual Reports

1.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

1.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

1.5: Forecasting Future Financial Performance Using Market Research

1.6: Valuing the Company Using DCF & Trading Multiples

2.1: Analyzing Business Segments, Industry Dynamics & Revenue Streams

2.2: Extracting and Cleaning Financial Data from Annual Reports

2.3: Modeling Income Statement, Balance Sheet & Cash Flow Statement

2.4: Evaluating Profitability, Efficiency & Liquidity Using Ratios

2.5: Forecasting Future Financial Performance Using Market Research

2.6: Valuing the Company Using DCF & Trading Multiples

Global Finance Through a Single Model

16 Lectures

1.1: Forecast all Financial line items

1.2: Build a 3-Statement Financial Model

1.3: Calculate WACC, Growth rate, and Key metrics

1.4: Perform Valuation using DCF and Comparables

2.1: Forecast all Financial line items

2.2: Build a 3-Statement Financial Model

2.3: Calculate WACC, Growth rate, and Key metrics

2.4: Perform Valuation using DCF and Comparables

3.1: Forecast all Financial line items

3.2: Build a 3-Statement Financial Model

3.3: Calculate WACC, Growth rate, and Key metrics

3.4: Perform Valuation using DCF and Comparables

4.1: Forecast all Financial line items

4.2: Build a 3-Statement Financial Model

4.3: Calculate WACC, Growth rate, and Key metrics

4.4: Perform Valuation using DCF and Comparables

Selling Numbers with Confidence and Clarity

15 h On Demand Videos

26 Lectures

1.1: Choosing Professional Color Themes and Keeping Slides Consistent

1.2: Formatting Slide Titles, Lines, and Shapes Cleanly

1.3: Using Slide Master to Maintain a Uniform Design

1.4: Creating Clear Heading Bars and Easy-to-Read Tables

2.1: Adding and Linking Excel Tables into PowerPoint Slides

2.2: Importing and Updating Excel Charts in Presentations

3.1: Using Background Images and Color Overlays Effectively

3.2: Cropping Images and Applying Professional Image Styles

3.3: Adding Simple Animations to Text, Charts, and Objects

3.4: Using Transitions to Create Smooth Slide Flow

4.1: Creating Hidden Slides for Extra or Backup Content

4.2: Using Presenter View for Confident Delivery

4.3: Adding Comments and Working with Team Feedback

4.4: Sharing and Exporting Presentations Professionally

5.1: Best Practices for Writing Clear and Professional Reports

5.2: Creating a Well-Structured Table of Contents

5.3: Writing a Clear and Insightful Executive Summary

5.4: Using Section Dividers for Better Report Navigation

5.4: Preparing a Strong Company Overview Section

6.1: Adding and Formatting Tables and Charts in Reports

6.2: Improving Layout, Alignment, and Visual Balance

6.3: Creating Clear and Professional Project Timelines

6.4: Writing and Presenting the Valuation Summary

6.5: Preparing a Concise Industry Overview

6.6: Writing a Strong Conclusion with Key Takeaways

6.7: Understanding Disclaimers, Footnotes, and Disclosures

Where Deals Are Built and Billion-Dollar Decisions Begin

30h:00m:00s On Demand Videos

40 Lectures

1.1: Accretion–Dilution, EPS Impact & Value Creation

1.2: Buyers, Strategy & M&A Modeling Framework

1.3: Course Introduction & M&A Overview

1.4: Deal Structure, Consideration & Key Assumptions

1.5: Pro Forma Balance Sheet & Consolidation Mechanics

1.6: Pro Forma DCF Valuation

1.7: Purchase Price, Equity Structure & PPA

1.8: Revenue, Cost Integration & Pro Forma Financials

1.9: Scenario Testing, Sensitivity Analysis & Model Review

1.10: Standalone Financial Model Structure & Statement Mapping

1.11: Transaction Stub Periods & Stub Financials

1.12: Working Capital, Depreciation, Debt & Cash Flow Modeling

2.1: Core Financial Statements & Cash Flow Mechanics

2.2: Dashboards, Model Validation, Circularity Control & Course Wrap-Up

2.3: Debt Repayment Profiles, Credit Metrics & Covenant Analysis

2.4: Enterprise Value, EBITDA Normalization & Exit Strategies

2.5: Equity Schedules, Cash Distributions & Exit Equity Value

2.6: Financing Assumptions, Fees & Debt Instrument Overview

2.7: Introduction to Leveraged Buyouts & LBO Transaction Overview

2.8: LBO Model Architecture, Design Standards & Full Model Tour

2.9: LBO Rationale, Buyers, Risks, Return Drivers & Market Context

2.10: Operating Assumptions & Revenue and Cost Modeling

2.11: Purchase Price Mechanics & Equity Offer Value

2.12: Returns Analysis, IRR, Cash-on-Cash & Sensitivity Tables

2.13: Revolver Modeling & Short-Term Liquidity Management

2.14: Sources and Uses of Funds & Capital Structure Setup

2.15: Term Loans, Subordinated Debt & Interest Calculations

2.16: Model Circularity and Checks

3.1: Course Introduction, Key Terms & Project Finance Fundamentals

3.2: Development Overview, Property Statistics & Cost Structure

3.3: Development Pro Forma, Sensitivity Analysis & Final Outputs

3.4: Distribution Waterfalls, Investor Returns & IRR Scenarios

3.5: Expense Modeling & Net Cash Flow Mechanics

3.6: Financing Structure: Land Loan, Construction Loan & Debt Schedules

3.7: Joint Ventures, Equity Contributions & Waterfall Structures

3.8: Levered Cash Flows, IRR & Project Returns

3.9: Model Assumptions Framework & Data Inputs

3.10: NOI, Cap Rates & Core Valuation Concepts

3.11: Real Estate Development Timeline, Capital Stack & Modeling Best Practices

3.12: Revenue Modeling: Absorption, Closings & Sales Build-Up

Financial Modeling & Valuation Analyst (FMVA®)

Market Opportunity

In today’s competitive job market, having the right skills is essential but not enough. To truly launch or accelerate your career in FMVA®, you need expert guidance, practical training, and the ability to showcase your skills effectively. At 365 BootCamp, we support you every step of the way from building job-ready skills with quality teaching to helping you present your expertise confidently and stand out in the crowd.

We help you in each and every step to achieve that:

$1000 Worth Portfolio Website

Create an ATS Resume

LinkedIn Optimization

Building Online Credibility

Virtual Internship

1,000,000 PKR

Average FMVA® Yearly Salary

Based on data from Economic Research Institute (ERI)

Career

Bootcamp Journey

May we help you?

Frequently Asked Questions

The FMVA® Course prepares you for roles as a Financial Analyst, Investment Banking Associate, Equity Research Analyst, Corporate Development Professional, and Private Equity Analyst. By mastering Real–World Modeling and Valuation skills, you’ll stand out in competitive Finance roles across industries.

Yes, we provide: • Help with Resume Writing and Interview Preparation. • Guidance for building a strong Online Professional Profile. • Referrals to Recruiters based on their requirements.

Many participants have secured Jobs after this Course, but our focus is on equipping you with In-Demand Skills and Practical Knowledge—your success ultimately depends on your Dedication and Consistent Effort.

You can interact with Instructors during Live Sessions, and they’re also available on WhatsApp for doubts or support outside class, ensuring personalized guidance throughout your learning journey.

Yes, a Finance Background is Recommended, as this Course is mainly designed for students with a Finance background and focuses on Financial Modelling and Valuation.

This Course is mainly for Students with a Finance Background, so prior knowledge in Finance is Recommended.

Yes, Absolutely! Learning has no Age Limit. Many Participants in their 40s and older have built successful careers in Financial Modelling and Valuation after completing this Course.

There are no Strict Prerequisites, but you’ll need: • A Laptop or Computer with at least 4GB-8GB of RAM for smooth performance. • A stable Internet Connection. • A strong desire to learn and grow in the field of Finacial Modelling and Valuation.

The Financial Modeling & Valuation Analyst (FMVA®) Certification is designed for anyone looking to build professional skills in Finance. It’s ideal for Students, Career Changers, and Working Professionals who want to strengthen their Financial Modeling, Valuation, and Analysis Expertise.

Courses are built by Industry Experts and include hands–on Excel Exercises, Case Studies, and Simulations that mirror real finance work. You’ll graduate with desk–ready skills you can apply immediately, along with templates and tools you can use on the job.

All classes are conducted Live via Zoom, offering an interactive learning experience where you can engage directly with instructors and fellow students.

No, we don’t offer Internships for this training program, as most participants are already Professionals in the Finance or Accounting field.

You’ll have Access to all Recorded Sessions for 1 Year on our LMS platform. You can review the content anytime within this period.

The Course runs for 4 Months and can be completed by studying 1–2 Hours a Day, 2 Days a Week.

Yes! Live Classes are scheduled flexibly for working professionals, and Recordings are Available if you miss a session.

You’ll gain expertise in Financial Accounting, Excel, Financial Modeling, Valuation, Dashboards, and Data Visualization, along with hands-on experience through real-world Finance Projects. You’ll also develop skills in Problem-Solving, Communication, Stakeholder Management, and AI Applications in various industries.

The Datasets used in this Bootcamp are specially designed to simulate Real-World Business Scenarios, drawing on years of industry experience. They contain over a Million Rows of Data and cover multiple aspects of business operations, providing learners with highly practical, hands-on experience.

Absolutely! All Webinar Sessions are Recorded, and as a Bootcamp Participant, you’ll always have Access to the Latest Session whenever you need it.

Yes, we offer an Installment Option for easier and more flexible payments.

We strive to keep our training affordable and partner with global companies to offer merit-based Scholarships and Financial Aid to deserving Students.

To earn the certificate, complete 70% of the course and score 70%+ in the final quiz. You’ll receive an E-Certificate, and on-site students will also get a Physical Certificate.

Yes, this training is designed to equip you with practical, job-ready skills in Financial Modeling and Valuation. We emphasize hands-on learning and real-world applications, ensuring you are fully prepared for industry requirements. Additionally, our curriculum covers essential topics such as Finance, Accounting, Excel, Financial Modeling, Valuation, Budgeting, Forecasting, Presentations, Dashboards, and Strategy.

Yes. The FMVA® certification is recognized globally and trusted by over 2 million professionals and organizations. Many graduates report promotions, new job offers, or successful career transitions after completing the program, making it one of the most respected credentials in corporate finance.

.